Difference Between ROCE and ROE

When analyzing the financial performance of a company, investors and analysts often focus on various profitability metrics to understand how efficiently a company is utilizing its resources. Two commonly used metrics are Return on Capital Employed (ROCE) and Return on Equity (ROE). While they are both measures of profitability, they have distinct purposes, calculations, and implications. Below is an in-depth explanation of ROCE and ROE, along with their key differences.

What is ROCE?

Return on Capital Employed (ROCE) measures a company’s profitability and the efficiency with which it uses its capital. It assesses how well a company generates profits from the total capital employed in the business.

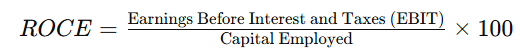

Formula for ROCE:

Where:

- Earnings Before Interest and Taxes (EBIT) represents operating profit.

- Capital Employed is the total capital invested in the company, which includes equity and debt. It can also be calculated as total assets minus current liabilities.

Significance of ROCE:

- Overall Efficiency: ROCE evaluates how effectively a company utilizes both equity and debt capital to generate profits.

- Comparison Across Industries: It is particularly useful in capital-intensive industries such as manufacturing or utilities, where significant amounts of fixed assets and long-term capital are employed.

- Debt-Inclusive Metric: ROCE includes debt in its calculation, making it a broader measure than ROE.

What is ROE?

Return on Equity (ROE) measures a company’s profitability relative to shareholders’ equity. It shows how effectively a company uses the funds provided by shareholders to generate net income.

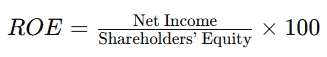

Formula for ROE:

Where:

- Net Income is the profit remaining after all expenses, taxes, and interest.

- Shareholders’ Equity is the residual interest in the assets of the company after deducting liabilities.

Significance of ROE:

- Equity Efficiency: ROE helps investors understand how effectively their invested capital is being utilized to generate profits.

- Shareholder-Centric Metric: It focuses solely on equity capital, making it particularly relevant to shareholders.

- Indicator of Profitability: A higher ROE generally indicates a more profitable and efficient company.

Key Differences Between ROCE and ROE

| Aspect | ROCE | ROE |

|---|---|---|

| Definition | Measures profitability based on total capital employed. | Measures profitability relative to shareholders’ equity. |

| Formula | EBIT / Capital Employed | Net Income / Shareholders’ Equity |

| Scope | Considers both equity and debt capital. | Focuses only on equity capital. |

| Purpose | Evaluates overall efficiency in utilizing total capital. | Assesses returns generated for shareholders. |

| Applicability | More relevant for companies with high debt or capital-intensive businesses. | Ideal for companies with low or no debt. |

| Stakeholder Perspective | Useful for lenders, shareholders, and management. | Primarily relevant to shareholders. |

| Inclusion of Debt | Includes debt in the capital employed. | Excludes debt; considers only equity. |

| Industry Relevance | Suitable for comparing companies in industries with large capital investments. | Useful across industries to gauge shareholder returns. |

Practical Example

Scenario 1: A Capital-Intensive Company Consider a manufacturing firm with significant investments in machinery and facilities. Suppose the firm’s EBIT is ₹50 crore, total assets are ₹500 crore, and current liabilities are ₹100 crore.

- Capital Employed = Total Assets – Current Liabilities = ₹500 crore – ₹100 crore = ₹400 crore.

- ROCE = (₹50 crore / ₹400 crore) × 100 = 12.5%.

Here, ROCE shows how efficiently the firm utilizes its capital base, including both equity and debt, to generate profits.

Scenario 2: A Technology Company For a software firm with minimal debt and a net income of ₹20 crore and shareholders’ equity of ₹100 crore:

- ROE = (₹20 crore / ₹100 crore) × 100 = 20%.

Here, ROE reflects the returns generated for shareholders, as equity is the primary source of capital in this case.

Which Metric Should You Use?

The choice between ROCE and ROE depends on the context of the analysis and the company’s capital structure:

- Use ROCE When:

- The company operates in a capital-intensive industry.

- You want to evaluate the overall profitability of the company, including the impact of debt financing.

- Use ROE When:

- The focus is on shareholder returns.

- The company has minimal debt, and equity is the primary funding source.

Conclusion

Both ROCE and ROE are essential financial metrics, but they serve different purposes. ROCE provides a broader perspective by considering all capital employed, making it ideal for assessing overall efficiency. On the other hand, ROE narrows the focus to shareholder returns, offering insight into equity utilization. By understanding the differences and applications of these metrics, investors and analysts can make more informed decisions about a company’s financial performance and investment potential.