CDSL Easiest: Features, Benefits, and Registration Process

Central Depository Services Ltd (CDSL) is a key player in India’s financial landscape. As one of the largest depositories in the country, it serves a crucial role in maintaining the financial ecosystem. To enhance user experience and infrastructure efficiency, CDSL provides online services such as CDSL Easi and CDSL Easiest. This article explores CDSL Easiest, its features, and the registration process.

What is CDSL?

CDSL is a depository that stores securities in a dematerialized format, eliminating the need for physical certificates. It facilitates seamless share transfers between demat accounts and offers various services through depository participants (DPs). Additionally, CDSL keeps track of all transactions within demat accounts. The platforms CDSL Easi and Easiest are designed to simplify and secure these processes.

Read also: Purchasing Power Parity (PPP): A Detailed Analysis

What is CDSL Easiest?

CDSL Easiest provides electronic access to securities information and enables secured transactions. While similar to CDSL Easi, it offers additional functionalities, including the ability to execute off-market and on-market instructions submitted by clearing members. It also supports inter-depository and early pay-in instructions.

Key Features of CDSL Easiest

- Digital Share Transfers: Users can transfer shares between demat accounts without requiring a delivery instruction slip (DIS).

- Off-Market Transactions: Particularly beneficial for handling unlisted securities, such as those of start-ups.

- Liquidity Management: Helps address liquidity constraints by enabling transfers of low-liquidity securities.

- Stamp Duty Calculation: Facilitates stamp-duty registration for off-market transactions.

- Corporate Announcements Tracking: Monitors updates related to securities in demat accounts, with the ability to track announcements for an additional 25 securities.

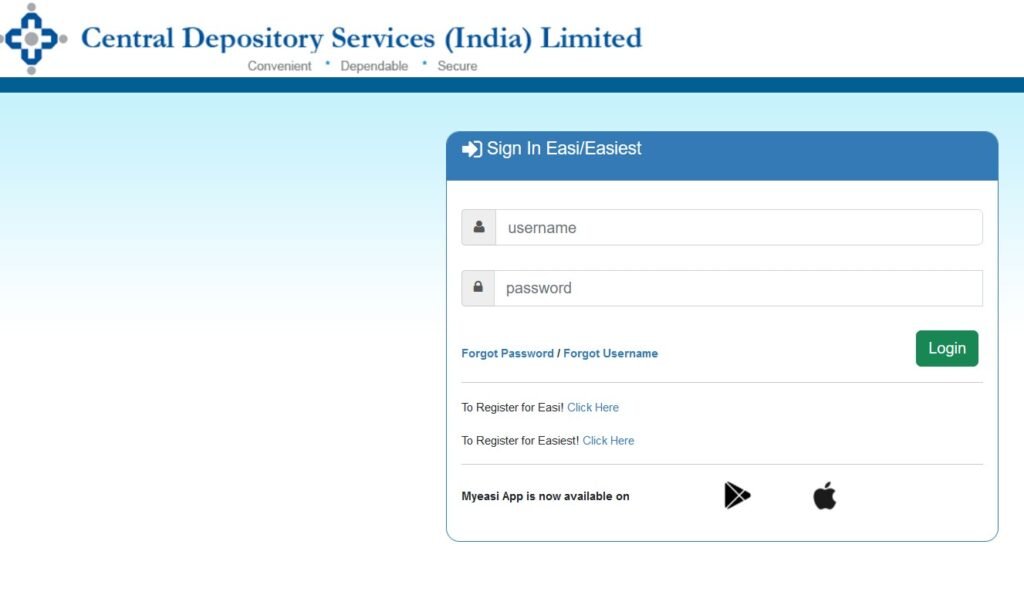

How to Register for CDSL Easiest

The registration process is simple and user-friendly:

- Visit the CDSL website: web.cdslindia.com/myeasitoken/home/login and click on “Register for Easiest.”

- Enter your 16-digit demat account number (BO ID).

- Use your PAN card number, birth date, and month in DDMM format as the password.

- Submit the details to receive an OTP on your registered email and phone number.

- Create a username, password, and security question.

- Add up to four trusted demat accounts for share transfers or leave this blank for later updates.

- Group multiple demat accounts under one username if needed.

- Click “Continue” to complete the process.

Existing CDSL Easi users can upgrade to Easiest by visiting the CDSL website and updating their BO ID.

TPIN for CDSL Easiest

A TPIN, authenticated via OTP, is required for transferring securities, adding an extra layer of security to ensure smooth and secure transactions.

Charges for CDSL Easiest

Registration for CDSL Easiest is free, and existing Easi users can upgrade without additional charges. However, standard DP charges may apply during transactions or share transfers.

Who Should Use CDSL Easiest?

CDSL Easiest is designed for beneficial owners (BOs) and clearing members (CMs) who want to submit debit or credit instructions digitally. It’s a convenient platform for users seeking seamless online share transfers, eliminating the need for physical DIS submissions.

With its robust features and user-friendly approach, CDSL Easiest is a valuable tool for those looking to efficiently manage their securities in today’s tech-driven financial environment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk. Consult with a qualified professional before making any investment decisions.

Read This: What Are Large Cap Stocks? Key Features, Advantages