Understanding Depreciation in Financial and Economic Analysis

Introduction

Depreciation is a crucial accounting and financial concept that represents the reduction in the value of an asset over time due to factors such as wear and tear, obsolescence, and usage. It allows businesses to allocate the cost of a tangible asset over its useful life, ensuring accurate financial reporting and tax calculations.

What is Depreciation?

Depreciation is the process of allocating the cost of a physical or tangible asset over its expected useful life. Instead of recording the entire cost of an asset in the year of purchase, businesses spread the expense over multiple years to match revenue generation with expenses.

Key Characteristics of Depreciation:

- Gradual Reduction in Value: Assets lose value over time due to wear and tear and technological advancements.

- Non-Cash Expense: Depreciation is recorded as an expense in financial statements but does not involve any cash outflow.

- Applicable to Tangible Assets: Depreciation applies to fixed assets like machinery, buildings, and vehicles but not to land (which usually appreciates in value).

Importance of Depreciation

Depreciation plays a critical role in financial management and accounting for businesses. Here’s why it matters:

- Accurate Financial Reporting:

- Helps reflect the true value of assets over time in balance sheets.

- Tax Benefits:

- Depreciation reduces taxable income, lowering tax liabilities.

- Cost Allocation:

- Spreads the cost of an asset over its useful life to match revenues with expenses.

- Investment Decision-Making:

- Helps businesses determine the right time to replace or upgrade assets.

Methods of Calculating Depreciation

There are several methods to calculate depreciation, depending on how an asset loses value over time.

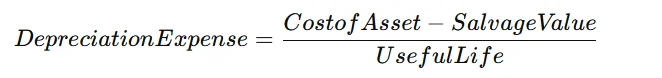

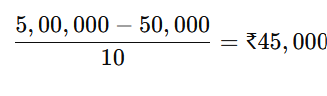

1. Straight-Line Method (SLM)

Formula:

Example: If a machine costs ₹5,00,000, has a salvage value of ₹50,000, and a useful life of 10 years, the annual depreciation will be:

Best For: Assets with consistent usage over time, such as office buildings and furniture.

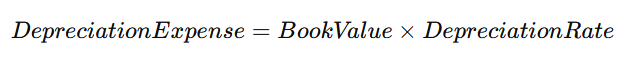

2. Declining Balance Method (Reducing Balance Method)

Applies a fixed percentage to the asset’s book value each year.

Formula:

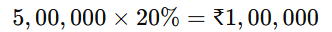

Example: If an asset worth ₹5,00,000 has a depreciation rate of 20%, the first-year depreciation would be:

Best For: Assets that lose value faster in initial years, such as computers and vehicles.

3. Units of Production Method

Depreciation is based on the asset’s usage rather than time.

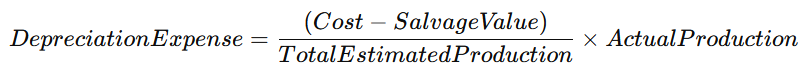

Formula:

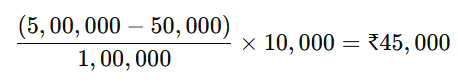

Example: If a machine costs ₹5,00,000, has a salvage value of ₹50,000, an expected output of 1,00,000 units, and produces 10,000 units in a year:

Best For: Assets with fluctuating usage, such as factory equipment.

4. Sum-of-the-Years’-Digits (SYD) Method

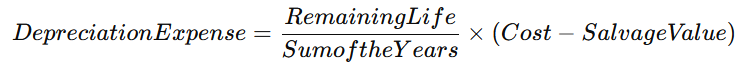

Assigns a higher depreciation expense in earlier years and lower amounts later.

Formula:

Best For: Assets that are more productive in their early years.

Depreciation in Taxation

Governments allow businesses to claim depreciation as a deduction to reduce taxable income. The Income Tax Act in many countries specifies depreciation rates and methods for different assets.

- India: The Income Tax Act allows businesses to use the Written Down Value (WDV) method for tax purposes.

- USA: The Modified Accelerated Cost Recovery System (MACRS) is used for tax depreciation.

Factors Affecting Depreciation

- Cost of the Asset: The higher the initial cost, the higher the depreciation.

- Useful Life: Estimated period an asset will be in productive use.

- Salvage Value: Expected value at the end of its useful life.

- Usage and Maintenance: More usage leads to higher depreciation.

- Economic and Technological Factors: Rapid technological changes can lead to faster obsolescence.

Depreciation vs. Amortization vs. Depletion

| Concept | Applies To | Method |

|---|---|---|

| Depreciation | Tangible fixed assets (buildings, machinery) | Various methods |

| Amortization | Intangible assets (patents, trademarks) | Straight-line method |

| Depletion | Natural resources (oil, minerals) | Units of production method |

Challenges in Depreciation Accounting

- Estimating Useful Life: Incorrect estimates can lead to inaccurate financial statements.

- Technological Changes: Assets may become obsolete faster than expected.

- Tax Regulations: Different rules for tax and accounting depreciation.

- Impact on Profitability: High depreciation expenses can lower net profits.

Conclusion

Depreciation is a vital accounting practice that helps businesses allocate asset costs over time, ensuring accurate financial reporting and tax efficiency. By understanding various depreciation methods, businesses can make informed decisions on asset purchases, maintenance, and replacements.

Regular review of depreciation policies is essential to align with changing business environments, technological advancements, and regulatory frameworks. Properly accounting for depreciation enhances financial transparency and aids in long-term strategic planning.