Budget 2025-26: Budget at a Glance

Introduction

The Union Budget 2025-26, presented by the Indian government, outlines the nation’s economic vision, expenditure priorities, and fiscal management strategies. This analysis delves deep into key aspects, including revenue sources, expenditure allocations, fiscal deficit trends, and sector-wise impacts. The budget aims to drive economic growth, improve social welfare, and strengthen infrastructure while ensuring fiscal discipline.

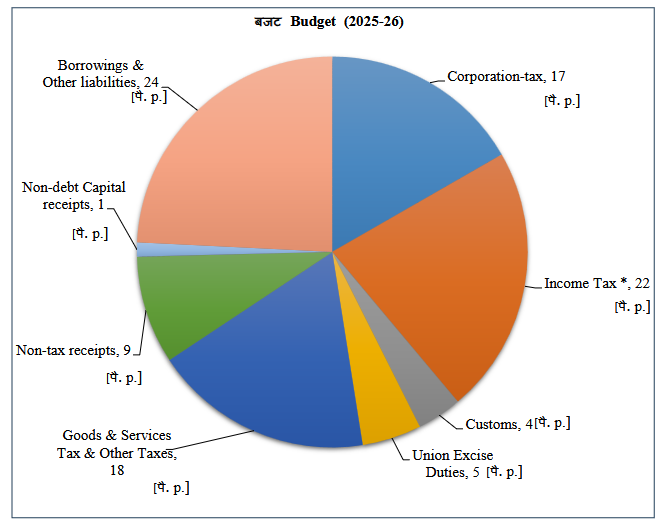

Revenue and Receipts: How the Government Earns

The government’s total revenue for 2025-26 is estimated at ₹50.65 lakh crore, with revenue receipts contributing ₹34.2 lakh crore. Here’s a breakdown:

- Tax Revenue (₹28.37 lakh crore): Income tax, GST, corporate tax, and excise duties remain major contributors.

- Non-Tax Revenue (₹5.83 lakh crore): Interest receipts, dividends from PSUs, and external grants.

- Capital Receipts (₹16.44 lakh crore): Comprising loans, disinvestments, and other non-debt receipts.

- Borrowings & Liabilities (₹15.69 lakh crore): Key for financing the fiscal deficit.

Expenditure Patterns: Rupee Comes From

Tax Reforms and Compliance Measures

- Simplified tax filing process for individuals and MSMEs.

- Introduction of AI-based tax assessment for greater transparency.

- Expansion of the faceless tax system to reduce corruption and improve efficiency.

Expenditure Patterns: Where the Money Goes

The budget allocates ₹50.65 lakh crore in total expenditure, including:

- Revenue Expenditure (₹39.44 lakh crore): Salaries, pensions, interest payments, and subsidies.

- Capital Expenditure (₹11.21 lakh crore): Infrastructure development, defense, and modernization projects.

- Effective Capital Expenditure (₹15.48 lakh crore): Including grants for capital asset creation.

Subsidies and Welfare Programs

- Food Subsidy: ₹2.03 lakh crore under PM Garib Kalyan Anna Yojana.

- Fertilizer Subsidy: ₹1.67 lakh crore to support farmers.

- Petroleum Subsidy: ₹12,100 crore for reducing fuel burden.

Fiscal Deficit and Economic Growth

The fiscal deficit for 2025-26 is estimated at 4.4% of GDP, a reduction from 4.8% in 2024-25, showing fiscal consolidation efforts. The revenue deficit stands at 1.5% of GDP, down from 1.9% in the previous year, highlighting better revenue collection and expenditure management.

Deficit Financing Measures

- Increased reliance on long-term bonds and green financing.

- Rationalization of subsidies to control spending.

- Enhanced focus on privatization and disinvestment to generate non-debt revenue.

Sectoral Allocations: Key Highlights

1. Infrastructure and Transportation

- ₹5.48 lakh crore for transport sector to boost highways, railways, and urban transit systems.

- Expansion of PM GatiShakti Plan for seamless connectivity and logistics efficiency.

- ₹1.5 lakh crore allocated for smart cities and metro expansion.

2. Agriculture and Rural Development

- PM-Kisan Scheme gets ₹63,500 crore to support farmers.

- MNREGA allocation at ₹86,000 crore to boost rural employment.

- PM Krishi Sinchai Yojana: ₹8,260 crore for irrigation development.

- Launch of a National Agri-Tech Fund to promote AI-driven farming techniques.

3. Defense and National Security

- ₹4.91 lakh crore for defense, focusing on modernization and border security.

- ₹71,000 crore for Border Roads Development, enhancing connectivity in strategic areas.

- ₹20,000 crore for indigenous defense manufacturing to boost self-reliance.

4. Education and Skill Development

- Samagra Shiksha: ₹41,250 crore to improve school education.

- PM SHRI Schools: ₹7,500 crore to establish model schools.

- PM Uchchatar Shiksha Abhiyan: ₹1,815 crore for higher education infrastructure.

- ₹10,000 crore allocated for AI and STEM research.

5. Health and Social Welfare

- Ayushman Bharat (PMJAY): ₹9,406 crore for universal health coverage.

- PM Poshan Scheme: ₹12,500 crore for school nutrition programs.

- Women and Child Development: ₹21,960 crore under POSHAN 2.0.

- ₹3,000 crore for mental health programs and AI-driven diagnostics.

6. Energy and Sustainability

- Jal Jeevan Mission: ₹67,000 crore for drinking water supply.

- Renewable Energy Expansion: ₹81,174 crore allocated for green energy initiatives.

- ₹5,000 crore for hydrogen energy and solar power expansion.

Major Policy Announcements and Reforms

- Taxation: No major changes in direct tax rates; simplification of compliance norms.

- Ease of Doing Business: New incentives for startups and MSMEs.

- Privatization & Disinvestment: Aims to raise ₹76,000 crore through stake sales in PSUs.

- Digital India Expansion: Strengthening AI, fintech, and semiconductor ecosystem.

- E-commerce and Digital Payments: Encouraging cashless transactions and regulating digital lending.

Challenges and Concerns

- Global Economic Slowdown: India needs to navigate uncertain global trade dynamics.

- Inflation Management: Ensuring food and fuel prices remain stable.

- Job Creation: Balancing automation with employment opportunities.

- Climate Change Risks: Strengthening disaster resilience in vulnerable areas.

Conclusion: What Lies Ahead?

The Budget 2025-26 reflects a balanced approach between growth-oriented spending and fiscal prudence. The government prioritizes infrastructure, agriculture, defense, and welfare schemes while maintaining fiscal discipline. While challenges such as global economic volatility and inflation persist, the budget positions India on a robust trajectory toward achieving its $5 trillion economy goal.

Stay tuned for further analysis on sectoral impacts and expert opinions!

Recommend: Budget Glossary: Key Terms and Definitions You Must Know

References:

The article based on https://www.indiabudget.gov.in/doc/Budget_at_Glance/budget_at_a_glance.pdf

Explore: https://www.indiabudget.gov.in/

VERY USEFULL INFORMATION.

Pingback: Expenditure on Major Items in Budget 2025-26: A Detailed Analysis - Bharat Articles

Pingback: Budget Glossary: Key Terms and Definitions You Must Know - Bharat Articles