World’s Biggest Arms Exporters list 2025

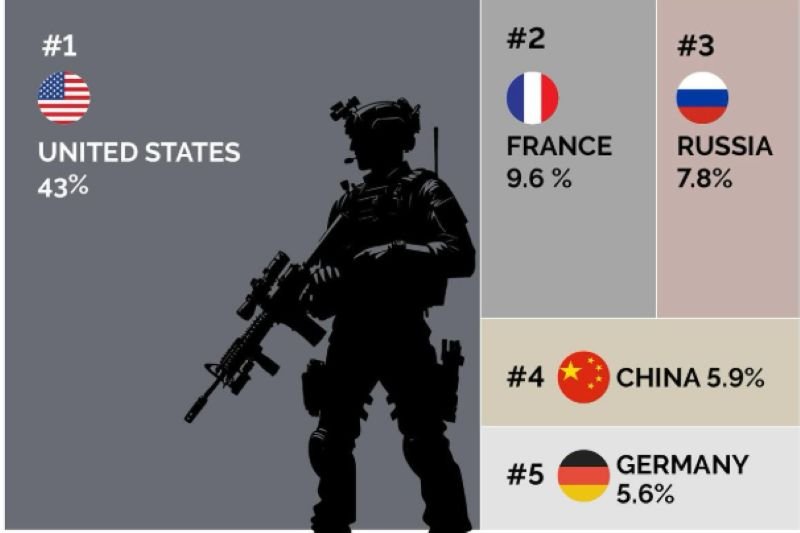

The global arms trade continues to reflect the evolving dynamics of power, diplomacy, and strategic alliances. According to the latest data from the Stockholm International Peace Research Institute (SIPRI), five countries dominate global arms exports, accounting for the lion’s share of international weapons trade between 2020 and 2024. These top exporters are the United States, France, Russia, China, and Germany.

Read This: World’s Largest Importers of Arms in 2025

Top 5 Arms Exporters: Global Market Share

- United States – 43%

- France – 9.6%

- Russia – 7.8%

- China – 5.9%

- Germany – 5.6%

These five countries collectively control over 70% of the world’s arms exports, supplying weapons and military systems to dozens of nations across all continents.

Where Are These Weapons Going?

1. United States (43% of global exports)

The U.S. remains the largest arms exporter by a wide margin. Its weapons reach a broad network of allies and strategic partners.

- Saudi Arabia – 12%

- Ukraine – 9.3%

- Japan – 8.8%

- Others – 69.9%

U.S. arms are valued for their technological superiority, but recent geopolitical shifts are challenging American dominance in certain regions, particularly Asia.

2. France (9.6% of global exports)

France has made significant gains in the global arms market, with a strong presence in Asia and the Middle East.

- India – 28%

- Qatar – 9.7%

- Greece – 8.3%

- Others – 54%

India has become France’s biggest defense customer, boosting French defense firms and reinforcing a growing bilateral military partnership.

3. Russia (7.8% of global exports)

Despite sanctions and international pressures, Russia remains a key global arms supplier, especially in Asia.

- India – 38%

- China – 17%

- Kazakhstan – 11%

- Others – 34%

India is also Russia’s largest arms customer, keeping Russia’s defense exports afloat during turbulent geopolitical periods.

4. China (5.9% of global exports)

China’s export performance has stagnated, with a narrow client base and concerns about the quality and effectiveness of its weapons systems.

- Pakistan – 63%

- Serbia – 6.8%

- Thailand – 4.6%

- Others – 25.6%

Much of China’s export volume is concentrated in Pakistan, where it has sold large quantities of often underperforming or outdated defense systems, raising questions about long-term reliability and operational value.

5. Germany (5.6% of global exports)

Germany has steadily grown as a trusted arms supplier in Europe and the Middle East.

- Ukraine – 19%

- Egypt – 19%

- Israel – 11%

- Others – 51%

Germany’s exports are often linked to conflict zones or countries involved in regional security operations.

Strategic Dependencies: India’s Central Role

India plays a critical role in shaping the arms export fortunes of both France and Russia. With 28% of France’s and 38% of Russia’s arms exports going to India, both countries are highly dependent on New Delhi for sustaining their defense industries. This reliance helps explain the consistent diplomatic support India receives from Paris and Moscow, especially in multilateral forums and during regional tensions.

On the other hand, China’s defense trade is narrowly focused, with Pakistan accounting for a staggering 63% of its exports. China’s strategy of supplying low-cost, mass-produced weaponry to Pakistan has often backfired, as many of these systems are regarded as technologically inferior or strategically ineffective. This has led to operational gaps for Pakistan in key defense areas, further widening the gap between Indian and Pakistani military capabilities.

India’s Rise as a Defense Exporter

While traditionally known as a major arms importer, India is now making strides in becoming a credible defense exporter. With government-backed initiatives like Make in India, the country is boosting domestic defense production and actively promoting indigenous systems to Southeast Asia, Africa, and even the Middle East. Indian-made drones, missiles, and naval systems are gradually gaining international attention for their cost-effectiveness and reliability.

This transition not only enhances India’s strategic autonomy but also positions it as a future competitor in the global arms market—challenging even established exporters like China.

Read This: BrahMos vs BrahMos-II

Conclusion

The global arms export landscape is marked by both entrenched powers and emerging shifts. While the U.S. continues to lead, its grip in some regions is loosening. France and Russia owe much of their export strength to India, underscoring India’s growing influence in global defense markets. Meanwhile, China’s overdependence on Pakistan and declining credibility in arms quality limits its global appeal. With India steadily expanding its defense production and exports, the coming years could witness a more multipolar arms trade dynamic—reshaped by strategic dependencies, regional rivalries, and rising indigenous capabilities.