What is the Expense Ratio in a Mutual Fund?

When investing in mutual funds, one of the most important metrics to consider is the expense ratio. It directly impacts your overall returns and provides insights into the fund’s efficiency in managing investor money. This article explores the concept of the expense ratio, its components, and its significance for mutual fund investors.

Understanding the Expense Ratio

The expense ratio is the annual fee charged by a mutual fund to manage your investment. It is expressed as a percentage of the fund’s average assets under management (AUM) and includes various costs incurred by the fund to operate effectively.

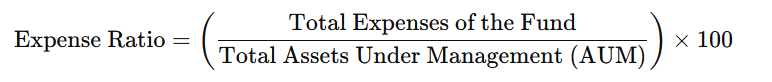

Formula:

Where:

- Total Expenses of the Fund = Management fees, administrative costs, marketing expenses, etc.

- Assets Under Management (AUM) = Total market value of the fund’s investments.

The expense ratio is expressed as a percentage and indicates the cost of managing the fund relative to its total assets. Lower expense ratios are generally preferable as they reduce the impact on investor returns.

For example, if a mutual fund has an expense ratio of 1%, it means that for every ₹100 you invest, ₹1 will be deducted annually to cover the fund’s expenses.

Components of the Expense Ratio

- Management Fees

- These are fees paid to the fund manager and their team for managing the portfolio.

- Administrative Costs

- Covers operational expenses like record-keeping, customer service, and regulatory compliance.

- Marketing and Distribution Fees

- Includes expenses for promoting the fund and distributing it through brokers or financial advisors.

- Other Costs

- Includes audit fees, legal charges, and any other miscellaneous expenses.

Types of Expense Ratios

- Equity Mutual Funds

- Generally have higher expense ratios compared to debt funds due to active management and research requirements.

- Debt Mutual Funds

- Typically have lower expense ratios as they involve relatively simpler strategies and lower risk.

- Index Funds/ETFs

- Have the lowest expense ratios because they track a benchmark index and require minimal active management.

- Direct Plans vs. Regular Plans

- Direct Plans: Lower expense ratios as they do not involve distributor commissions.

- Regular Plans: Higher expense ratios due to the inclusion of distributor fees.

Importance of the Expense Ratio

- Impact on Returns

- A higher expense ratio reduces your net returns, while a lower expense ratio allows you to retain more of your investment gains.

- Fund A with a 2% expense ratio and a 10% return will leave you with an 8% net return.

- Fund B with a 1% expense ratio and the same 10% return will leave you with a 9% net return.

- Indicator of Fund Efficiency

- A reasonable expense ratio indicates that the fund is cost-efficient and not overly burdening investors with fees.

- Comparison Metric

- Helps in comparing funds within the same category to identify cost-effective options.

How to Evaluate Expense Ratios

- Check SEBI Limits

- In India, the Securities and Exchange Board of India (SEBI) caps the maximum expense ratio that a mutual fund can charge.

- For equity funds: 2.25% (approx.)

- For debt funds: 2.00% (approx.)

- Consider Fund Category

- Compare expense ratios within the same category (e.g., equity funds, debt funds, or index funds).

- Analyze Returns

- Ensure that the fund’s performance justifies its expense ratio.

- A fund with a higher expense ratio should ideally deliver higher returns.

- Focus on Direct Plans

- Opt for direct plans to reduce costs and improve net returns.

Pros and Cons of Expense Ratios

Pros:

- Covers Operational Costs:

- Ensures the fund operates smoothly and provides professional management.

- Transparent:

- Investors can easily access information about the expense ratio in fund fact sheets and offer documents.

Cons:

- Reduces Returns:

- Higher expense ratios directly impact your net returns.

- May Not Justify Performance:

- Some funds with high expense ratios may not deliver proportionally higher returns.

Conclusion

The expense ratio is a critical factor that affects your mutual fund investment journey. While it may seem like a small percentage, its impact compounds over time, especially for long-term investments. As an informed investor, always compare expense ratios across similar funds and opt for those that balance cost and performance effectively. By keeping an eye on this metric, you can maximize your returns and achieve your financial goals more efficiently.