Nifty Midcap 150 Index: Comprehensive Guide

Introduction

The Nifty Midcap 150 is a stock market index that tracks the performance of mid-sized companies listed on the National Stock Exchange (NSE) of India. It provides investors with a benchmark to measure the growth and stability of midcap stocks, which fall between large-cap and small-cap companies in terms of market capitalization.

Midcap stocks are known for their growth potential and relatively higher volatility compared to large-cap stocks. The Nifty Midcap 150 index plays a crucial role for investors looking for diversified investment opportunities in this segment.

Understanding the Nifty Midcap 150 Index

The Nifty Midcap 150 Index consists of 150 stocks that are ranked between 51st and 200th in terms of market capitalization on the NSE. This index is designed to capture the overall movement and performance of midcap stocks in India.

Key Features of Nifty Midcap 150:

- Comprehensive Midcap Representation: It covers a wide range of mid-sized companies across multiple industries.

- Free-Float Market Capitalization-Based Index: Stocks are weighted based on their free-float market capitalization, ensuring a fair representation of the actual market value of stocks available for trading.

- Sectoral Diversification: The index includes companies from various sectors, reducing concentration risk and providing a balanced portfolio.

- Semi-Annual Rebalancing: The index is reviewed and reconstituted twice a year (March and September) to ensure relevance and accuracy.

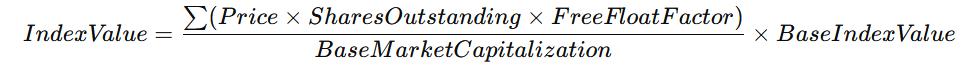

Calculation Methodology

The Nifty Midcap 150 Index is calculated using the free-float market capitalization-weighted method, meaning the weight of each stock is based on its market capitalization adjusted for free-float shares.

Formula for Index Calculation:

Where:

- Price = Market price of each stock

- Shares Outstanding = Total number of shares issued

- Free Float Factor = Proportion of shares available for public trading

- Base Market Capitalization = Market capitalization of stocks during the base period

- Base Index Value = Typically set at 1000 during the launch of the index

This calculation ensures that the index reflects real-time market movements based on actual tradable stocks.

Sectoral Composition and Diversity

One of the strengths of the Nifty Midcap 150 index is its sectoral diversification. Midcap stocks belong to various industries such as banking, finance, healthcare, technology, consumer goods, industrial manufacturing, and real estate.

Some of the key sectors and their typical weightage in the index include:

- Financial Services – Banks, NBFCs, insurance companies

- Consumer Goods & Retail – FMCG, automobile manufacturers

- Pharmaceuticals & Healthcare – Drug manufacturers, hospital chains

- Technology & IT Services – Software companies, IT-enabled services

- Industrial Manufacturing – Engineering, infrastructure, power, and energy companies

- Real Estate & Construction – Developers and infrastructure firms

This sectoral mix ensures that investors gain exposure to a well-balanced portfolio, reducing dependency on any single industry.

Why is the Nifty Midcap 150 Index Important?

1. Benchmark for Midcap Mutual Funds and ETFs

Many midcap mutual funds and exchange-traded funds (ETFs) use the Nifty Midcap 150 as their benchmark index to evaluate fund performance.

2. Higher Growth Potential Compared to Large-Cap Stocks

Midcap stocks often have higher growth potential as they are in their expansion phase. Many of today’s large-cap companies started as midcap firms.

3. Economic Indicator for Market Trends

Since midcap companies are more dynamic and responsive to market conditions, the Nifty Midcap 150 index often serves as a leading indicator of economic trends and investor sentiment.

4. Risk and Volatility Considerations

- Higher Volatility: Midcap stocks are more volatile than large caps, making the index prone to higher fluctuations.

- Liquidity Risk: Some midcap stocks have lower trading volumes, affecting ease of buying and selling.

- Potential for High Returns: Historically, midcaps have delivered better returns over long-term periods compared to large caps.

Performance of Nifty Midcap 150 Index

Historically, the Nifty Midcap 150 has outperformed the Nifty 50 over long investment periods. However, it also experiences sharper corrections during bear markets.

Past Performance Trends:

- Over the last 5–10 years, the Nifty Midcap 150 has consistently delivered stronger returns than large-cap indices.

- During bull markets, midcaps tend to outperform large caps due to their higher growth potential.

- In bear markets, midcap stocks suffer greater losses as they are more sensitive to economic downturns.

How to Invest in Nifty Midcap 150?

There are multiple ways to invest in the Nifty Midcap 150 Index:

1. Direct Investment in Stocks

Investors can directly buy individual stocks from the Nifty Midcap 150, selecting companies based on fundamental and technical analysis.

2. Midcap Mutual Funds & ETFs

Many fund houses offer midcap-focused mutual funds and exchange-traded funds (ETFs) that track the performance of the Nifty Midcap 150.

3. Index Funds

Investing in index funds that replicate the Nifty Midcap 150 allows for passive investment in the entire midcap segment.

Risks and Challenges

While investing in the Nifty Midcap 150 Index offers significant growth potential, it also comes with certain risks:

- Market Volatility – Midcaps are prone to higher price fluctuations.

- Liquidity Risk – Some midcap stocks may have lower liquidity, making it difficult to execute large trades.

- Economic Sensitivity – Midcap stocks are more sensitive to economic downturns compared to large caps.

- Stock-Specific Risks – Certain midcap stocks may face governance issues, financial instability, or sector-specific downturns.

Conclusion

The Nifty Midcap 150 Index serves as an essential benchmark for investors looking to tap into high-growth midcap stocks. With its diverse sectoral representation, strong long-term return potential, and role as a key economic indicator, the index is an attractive option for both active and passive investors.

However, due to its higher volatility and risk, investors must have a long-term investment horizon and a well-diversified portfolio to mitigate potential downturns. Whether investing directly in stocks, through midcap mutual funds, ETFs, or index funds, the Nifty Midcap 150 offers significant opportunities for wealth creation.

For investors willing to accept moderate to high risk in exchange for potentially higher returns, the Nifty Midcap 150 remains one of the best ways to gain exposure to India’s growing midcap segment.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. This does not constitute a personal recommendation/investment advice. It does not aim to influence any individual or entity to make investment decisions. Recipients should conduct their own research and assessments to form an independent opinion about investment decisions.

Pingback: What is Nifty and How It is Calculated? - Bharat Articles