APR vs. APY: What’s the Difference?

When managing finances or evaluating investment opportunities, you often come across two terms: APR (Annual Percentage Rate) and APY (Annual Percentage Yield). While these terms may seem similar, they serve distinct purposes and are essential for understanding the true cost or return on financial products. Here’s a comprehensive guide to help you grasp the difference between APR and APY.

What Is APR?

Annual Percentage Rate (APR) represents the yearly interest rate charged by lenders or earned on investments, excluding the effects of compounding. It is a straightforward percentage that helps borrowers and investors compare financial products.

How APR Works

APR is commonly used in loans, credit cards, and mortgages. It provides a clear picture of the cost of borrowing over a year, including certain fees but excluding compounding.

For example:

- If you take out a loan with a 10% APR, you’ll pay $10 per $100 borrowed annually, assuming no compounding.

Types of APR

- Fixed APR: The interest rate remains constant throughout the loan term.

- Variable APR: The interest rate fluctuates based on market conditions or the prime rate.

What Is APY?

Annual Percentage Yield (APY) accounts for compounding interest, showing the actual rate of return on investments or savings over a year. It reflects the effect of earning interest on both the principal and the accumulated interest.

How APY Works

APY is used for savings accounts, certificates of deposit (CDs), and investment products. It provides a clearer picture of the total return over time.

For example:

- A savings account with a 5% APY means you’re not just earning interest on your initial deposit but also on the interest added to your account periodically.

Key Differences Between APR and APY

| Feature | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

|---|---|---|

| Definition | Measures the cost of borrowing money. | Measures the actual return on investments. |

| Compounding | Does not account for compounding. | Includes the effects of compounding. |

| Use Cases | Loans, mortgages, and credit cards. | Savings accounts, CDs, and investments. |

| Calculation Basis | Simple interest over a year. | Compound interest over a year. |

| Representation | Cost to borrowers. | Gain for investors. |

Why Understanding the Difference Matters

- For Borrowers:

- A lower APR may seem appealing, but if compounding occurs, your effective cost can increase.

- Always ask for the Effective Annual Rate (EAR), which factors in compounding, to make informed decisions.

- For Investors:

- APY gives a clearer view of actual returns. Even if the nominal interest rate is low, compounding can lead to significant gains over time.

How to Calculate APR and APY

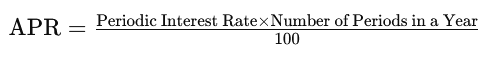

APR Formula

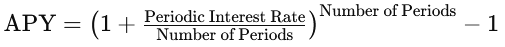

APY Formula

Example:

- APR: 5% annual interest rate.

- APY: If compounded monthly, the APY becomes approximately 5.12%.

Practical Tips

- Compare Financial Products Accurately:

- Use APR for loans and APY for savings to make fair comparisons.

- Consider Compounding Frequency:

- The more frequent the compounding, the higher the APY, even if the APR remains constant.

- Ask Questions:

- Always inquire about hidden fees, compounding terms, and how interest is applied.

Conclusion

Understanding APR and APY is crucial for making informed financial decisions. APR focuses on the cost of borrowing, while APY highlights the actual return on investments by factoring in compounding. By mastering these concepts, you can better navigate loans, credit cards, savings accounts, and other financial products, ensuring you maximize gains and minimize costs.