Absolute Return vs CAGR: What’s the Difference?

Investors often encounter terms like Absolute Return and CAGR (Compound Annual Growth Rate) when evaluating their investments. While both metrics measure performance, they serve different purposes and provide unique insights. In this article, we’ll explore these two concepts in detail, understand their formulas, and see how they differ with examples.

What is Absolute Return?

Absolute Return measures the total percentage change in the value of an investment over a specific period, regardless of the time it took to achieve it. It is a straightforward metric, offering a simple snapshot of how much profit or loss was made.

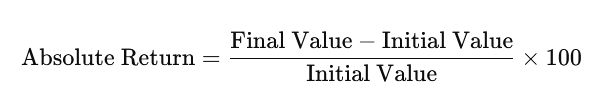

Formula:

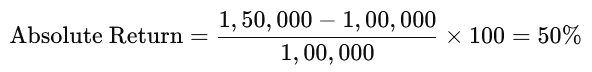

Example:

Suppose you invested ₹1,00,000 in a mutual fund, and its value grew to ₹1,50,000 in three years. Absolute Return=1,50,000−1,00,0001,00,000×100=50%\text{Absolute Return} = \frac{1,50,000 – 1,00,000}{1,00,000} \times 100 = 50\%

This means your investment grew by 50% over three years. However, it doesn’t tell you the yearly growth rate.

What is CAGR?

CAGR stands for Compound Annual Growth Rate and measures the mean annual growth rate of an investment over a specified period, assuming the profits are reinvested. It reflects how much an investment would have grown each year if it had grown at a steady rate.

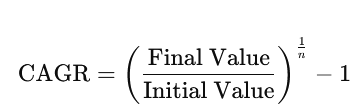

Formula:

Where:

- Final Value = Value of the investment at the end of the period

- Initial Value = Value of the investment at the beginning of the period

- n = Number of years

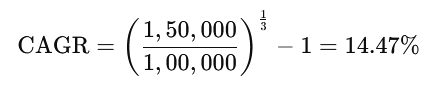

Example:

Using the same example, if your investment of ₹1,00,000 grew to ₹1,50,000 in three years:

This means your investment grew by an average of 14.47% per year over the three years.

Key Differences Between Absolute Return and CAGR

| Aspect | Absolute Return | CAGR |

|---|---|---|

| Definition | Total return over the investment period | Average annual growth rate assuming compounding |

| Time Factor | Does not consider time | Takes time into account |

| Usefulness | Simple and easy for short-term investments | Ideal for long-term investments |

| Formula Complexity | Simple | More complex |

| Interpretation | Reflects overall performance | Reflects consistent annual growth |

Example Comparison:

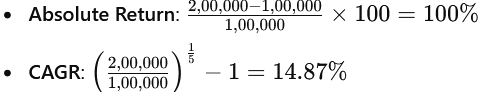

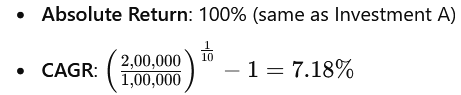

- Investment A: ₹1,00,000 grows to ₹2,00,000 in 5 years.

- Investment B: ₹1,00,000 grows to ₹2,00,000 in 10 years.

While both have the same absolute return, CAGR highlights that Investment A grew at a faster rate.

When to Use Absolute Return?

- For short-term investments or when the time horizon is not critical.

- To quickly compare two investments without considering time.

- Example: Evaluating returns from fixed deposits or savings schemes.

When to Use CAGR?

- For long-term investments to understand consistent growth over time.

- To compare growth rates across investments with different timeframes.

- Example: Evaluating mutual funds, equity investments, or SIP (Systematic Investment Plan) performance.

Conclusion

Absolute Return and CAGR are valuable tools for measuring investment performance, but they cater to different scenarios. Absolute Return is straightforward and best for short-term evaluation, while CAGR provides a nuanced understanding of long-term growth with compounding.

Investors should choose the metric that aligns with their investment goals and timelines to make informed financial decisions.