DigiSaathi Portal: Empowering India’s Digital Payment Ecosystem

India has witnessed a remarkable transformation in its financial landscape over the last decade. With the rise of digital payment systems and the growing emphasis on cashless transactions, millions of people now rely on technology for their daily financial needs. However, as digital adoption increases, so does the need for proper guidance and support. To address this, the Government of India, in collaboration with the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI), launched DigiSaathi – a dedicated portal to assist users in navigating the world of digital payments. This article explores the features, benefits, and significance of the DigiSaathi portal.

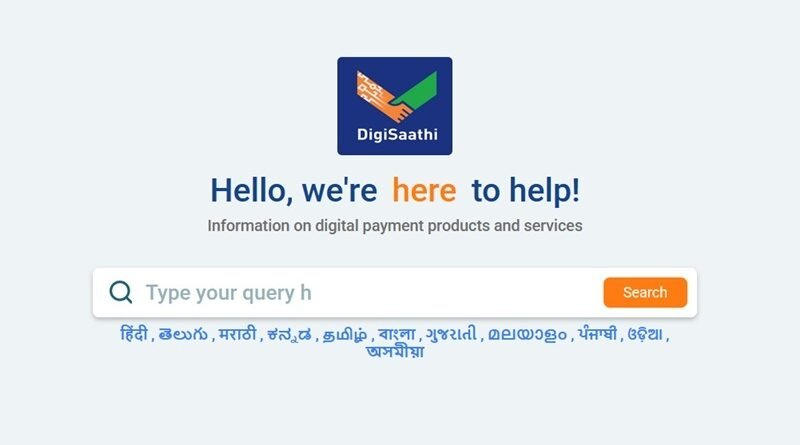

What Is DigiSaathi?

DigiSaathi is an initiative designed to provide instant, reliable assistance for queries related to digital payment systems. It is a multi-channel helpline service aimed at helping individuals understand and use various digital payment methods while ensuring safe and secure transactions. By offering guidance on a wide range of topics, DigiSaathi empowers users to embrace digital payments confidently.

Objectives of DigiSaathi

The DigiSaathi portal was created with the following key objectives:

- Promoting Digital Literacy: To educate users about the various digital payment systems available in India.

- Enhancing User Confidence: To build trust in digital platforms by providing accurate and timely information.

- Providing Round-the-Clock Support: To ensure users have access to assistance whenever they need it.

- Preventing Fraud: To spread awareness about safe digital transaction practices and protect users from potential scams.

Key Features of the DigiSaathi Portal

The DigiSaathi portal is user-friendly and packed with features that make it an essential resource for digital payment users. Some of its standout features include:

1. 24/7 Availability

DigiSaathi operates round the clock, ensuring that users can access assistance at any time of the day or night. This is particularly helpful for resolving issues outside traditional banking hours.

2. Multi-Channel Support

Users can access DigiSaathi through various channels, including:

- Toll-Free Numbers: Call 14431 or 1800-891-3333 for voice-based assistance.

- WhatsApp Chatbot: Message +91-892-891-3333 to interact with an automated chatbot.

- Website: The DigiSaathi portal offers detailed FAQs, guides, and self-help resources.

3. Wide Range of Topics

The portal covers a comprehensive list of topics related to digital payments, including:

- Setting up and using UPI (Unified Payments Interface).

- Understanding QR code payments and mobile wallets.

- Troubleshooting internet banking and card payment issues.

- Learning about safe practices to avoid fraud and scams.

4. Automated Assistance

DigiSaathi leverages chatbots and IVR (Interactive Voice Response) systems to provide quick and accurate answers to common queries. For complex issues, users are directed to appropriate resources or services.

5. Language Support

To cater to India’s diverse population, DigiSaathi provides assistance in multiple languages, making it accessible to people from various regions.

How DigiSaathi Works

Step 1: Access the Portal : https://digisaathi.info/

Users can visit the DigiSaathi website, call the toll-free numbers, or interact with the WhatsApp chatbot.

Step 2: Choose Your Query Type

The platform categorizes queries into topics such as UPI, mobile wallets, internet banking, card payments, and more. Users can select the relevant topic for personalized guidance.

Step 3: Get Solutions

Based on the query, DigiSaathi provides step-by-step instructions, troubleshooting tips, or directs users to relevant services. If needed, users are guided to escalate their issues to their bank or payment service provider.

Benefits of DigiSaathi

DigiSaathi has been instrumental in bridging the gap between technology and users. Here are some of its major benefits:

- Increased Digital Adoption: By simplifying the use of digital payments, DigiSaathi encourages more people to transition to cashless transactions.

- Empowered Users: With access to accurate information and guidance, users feel more confident in using digital platforms.

- Fraud Prevention: DigiSaathi educates users about potential scams and safe transaction practices, reducing the risk of fraud.

- Improved Accessibility: The multi-channel approach ensures that users from urban and rural areas alike can access support.

- Time-Saving: Instant assistance through automated systems saves users from lengthy troubleshooting processes.

Significance of DigiSaathi in India’s Digital Ecosystem

India’s digital payment ecosystem has grown exponentially, with UPI alone processing billions of transactions each month. However, this rapid growth has also brought challenges like fraud, technical issues, and user confusion. DigiSaathi addresses these challenges by:

- Building Trust: A reliable helpline fosters trust among users who are new to digital payments.

- Supporting Financial Inclusion: By making digital payments more accessible, DigiSaathi helps bring unbanked and underbanked populations into the financial system.

- Reducing Pressure on Banks: By handling basic queries, DigiSaathi reduces the burden on banks’ customer support teams.

Challenges and the Way Forward

While DigiSaathi is a valuable resource, it faces certain challenges, such as:

- Awareness: Many users, especially in rural areas, are unaware of DigiSaathi’s existence.

- Limited Human Support: Automated systems may not be sufficient for complex queries that require human intervention.

- Language Coverage: Expanding support to more regional languages can enhance accessibility.

To address these issues, increasing awareness campaigns, integrating human support for escalated queries, and enhancing multilingual capabilities can make DigiSaathi even more effective.

Conclusion

The DigiSaathi portal is a transformative initiative that aligns with India’s vision of a cashless and digitally empowered economy. By providing reliable, round-the-clock support, it empowers users to embrace digital payments with confidence. As digital adoption continues to grow, platforms like DigiSaathi will play a crucial role in ensuring a seamless and secure experience for all. With ongoing improvements and increased awareness, DigiSaathi has the potential to become a cornerstone of India’s digital financial infrastructure.

Explore official website: https://digisaathi.info

Pingback: What is Statutory Liquid Ratio (SLR)? - Bharat Articles

Pingback: Form 15G & Form 15H: Usage and Eligibility for TDS in India - Bharat Articles