GDP vs. GVA: Understanding the Key Differences in Economic Measurement

Introduction

Gross Domestic Product (GDP) and Gross Value Added (GVA) are two essential indicators used to measure economic performance. While both provide insights into the economic health of a nation, they differ in their calculation, usage, and interpretation. Understanding the distinctions between GDP and GVA is crucial for economists, policymakers, and analysts in making informed economic decisions.

What is GDP?

Definition:

Gross Domestic Product (GDP) represents the total monetary value of all final goods and services produced within a country’s borders during a specific period, typically a quarter or a year. It serves as the primary indicator of a nation’s economic performance.

Key Characteristics of GDP:

- Comprehensive Measure: Encompasses all sectors of the economy, including agriculture, industry, and services.

- Final Output Focus: Includes only final goods and services to avoid double counting.

- Widely Used Metric: Used by governments, international organizations, and financial institutions to assess economic growth.

Methods of Calculating GDP:

There are three primary approaches to GDP calculation:

- Production Method:

- GDP = Total Output – Intermediate Consumption

- Income Method:

- GDP = Wages + Rent + Interest + Profit + Taxes – Subsidies

- Expenditure Method:

- GDP = Consumption + Investment + Government Spending + (Exports – Imports)

What is GVA?

Definition:

Gross Value Added (GVA) measures the contribution of each sector to the economy by calculating the value of output minus the value of intermediate goods and services used in production.

Key Characteristics of GVA:

- Sector-Specific Measure: Provides insights into the economic contribution of different industries.

- Production-Centric: Focuses on the value added during the production process.

- Used for Policy Decisions: Helps policymakers analyze sectoral performance and make economic interventions.

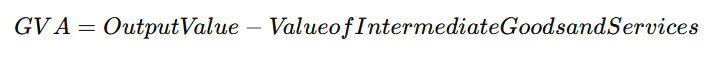

Formula for GVA Calculation:

GDP vs. GVA: Key Differences

| Factor | GDP | GVA |

|---|---|---|

| Definition | Total value of all final goods and services produced within a country. | Contribution of each sector to the economy, calculated as output minus intermediate costs. |

| Scope | Macroeconomic measure of overall economic performance. | Sectoral economic measure showing industry-wise contribution. |

| Calculation | Sum of consumption, investment, government spending, and net exports. | Difference between total output and intermediate consumption. |

| Usage | Used for international comparisons, policymaking, and economic growth analysis. | Used for assessing sector-specific performance and economic planning. |

| Relationship | Derived from GVA by adding taxes on products and subtracting subsidies on products. | More detailed and disaggregated than GDP. |

How GDP and GVA are Related

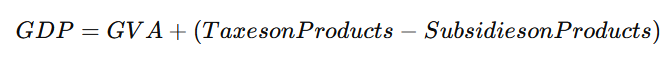

GDP and GVA are closely linked. The relationship can be expressed as:

Taxes and subsidies influence the final GDP figure, making GVA a useful indicator for understanding the actual production-related value addition in the economy.

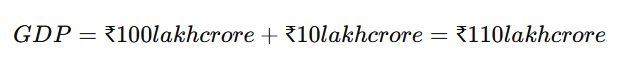

Example:

- If a country’s GVA is ₹100 lakh crore, and net taxes (taxes – subsidies) amount to ₹10 lakh crore, then the GDP would be:

Which Indicator is More Important?

- GDP is essential for overall economic performance evaluation and international comparisons.

- GVA is crucial for sector-wise analysis, helping policymakers identify which industries are driving growth or struggling.

Example: During the COVID-19 pandemic, GVA analysis helped identify which sectors (e.g., manufacturing, services, agriculture) were most affected, allowing for targeted policy interventions.

Challenges in Measuring GDP and GVA

Challenges in GDP Calculation:

- Informal Economy: In developing countries, a large informal sector is often underreported.

- Price Fluctuations: Inflation can distort GDP comparisons over time.

- Data Accuracy: Dependence on government and institutional data sources can lead to discrepancies.

Challenges in GVA Calculation:

- Sectoral Disruptions: External shocks (e.g., pandemics, natural disasters) affect certain industries disproportionately.

- Difficulty in Estimating Intermediate Consumption: Misestimating production costs can lead to inaccurate GVA values.

- Frequent Revisions: Government agencies often revise base years and calculation methods, impacting consistency.

Conclusion

Both GDP and GVA are essential economic indicators, but they serve different purposes. GDP provides a broad picture of economic health, while GVA offers deeper insights into sectoral contributions. Policymakers, economists, and businesses must analyze both metrics to gain a comprehensive understanding of economic trends and make informed decisions.

Understanding the GDP-GVA relationship ensures better economic planning, accurate forecasting, and effective policy formulation for sustainable economic growth.

Pingback: The top 10 largest economies in the world in 2025 - Bharat Articles