What are Bearer Cheques: Meaning, Writing, and Benefits

Bearer cheques are a form of financial instrument that allows the holder to receive the designated amount of money without the need for identification. This article will delve into the meaning of bearer cheques, how to write them, the rules surrounding their withdrawal, who can withdraw them, whether they can be encashed at any bank, their advantages, and essential precautions to take when handling them.

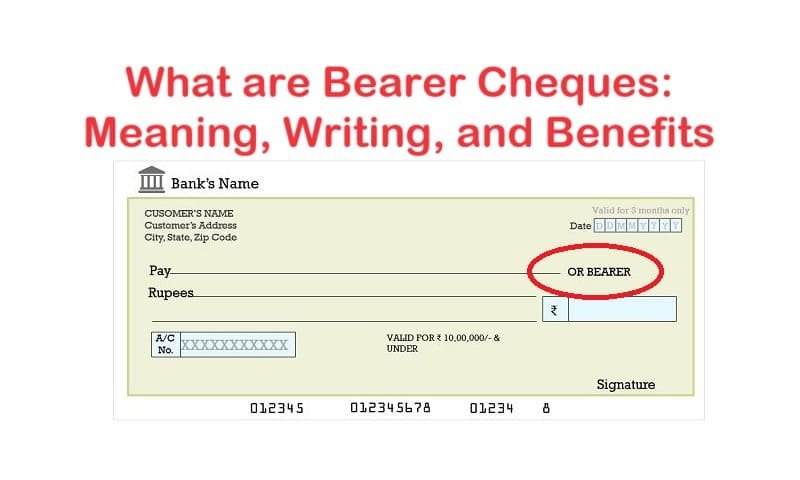

What are Bearer Cheques?

A bearer cheque is a type of cheque where the payment is made to the person holding the cheque, without the need for further identification. Unlike order cheques, which require the payee to be specified, bearer cheques are payable to whoever presents them at the bank. This characteristic makes them a highly liquid form of payment, akin to cash.

How to Write a Bearer Cheque

Writing a bearer cheque is straightforward:

- Date: Write the current date in the provided space.

- Payee’s Name: In the “Pay” field, write “Bearer” instead of specifying a name. You can also leave this field blank, as this implies the cheque is a bearer cheque.

- Amount: Enter the amount in words and figures clearly.

- Signature: Sign the cheque as per your bank’s specimen signature.

For example:

- Date: 25th May 2024

- Pay: Bearer

- Amount: Five Thousand Dollars only ($5000)

- Signature: [Your Signature]

What are the Withdrawal Rules on Bearer Cheques?

The primary rule for withdrawing funds using a bearer cheque is that the person presenting the cheque does not need to show identification. The cheque can be cashed immediately upon presentation at the issuing bank or another bank, subject to interbank agreements and sufficient funds being available.

Who Can Withdraw a Bearer Cheque?

Anyone in possession of a bearer cheque can withdraw the funds. This lack of requirement for identification or verification makes it crucial for the drawer to ensure the cheque does not fall into unauthorized hands.

Can You Encash a Bearer Cheque from Any Bank?

While bearer cheques can be encashed at any bank, it is generally more straightforward to cash them at the issuing bank. Other banks may impose additional scrutiny or even refuse to honor the cheque if they cannot verify the drawer’s account status or balance. It’s advisable to check with the respective bank’s policy on encashing bearer cheques before attempting to do so.

Advantages of a Bearer Cheque

- Convenience: Easy to transfer ownership by simply handing it over.

- Speed: Can be cashed immediately without the need for payee identification.

- Flexibility: Useful for quick, on-the-spot transactions.

What Are the Things to Remember Before Carrying a Bearer Cheque?

- Security: Bearer cheques can be cashed by anyone who holds them, so they should be handled with the same care as cash.

- Fraud Risk: The lack of need for identification increases the risk of theft and fraud.

- Endorsement: Endorsing a bearer cheque can convert it into an order cheque, which provides a layer of security as it then requires identification.

ConclusionBearer cheques are a convenient financial instrument that can be used for quick and easy transactions. However, due to their high liquidity and lack of security, they must be handled with care. Understanding the proper way to write and use a bearer cheque, along with the associated risks, can help in utilizing this instrument effectively while minimizing potential downsides. Always consider the security implications and handle bearer cheques as you would handle cash to prevent unauthorized encashment.