India-China Consumption Comparison

In 2023, India overtook China to become the world’s most populous country. Read this article for a comprehensive comparison of consumption patterns between India and China.

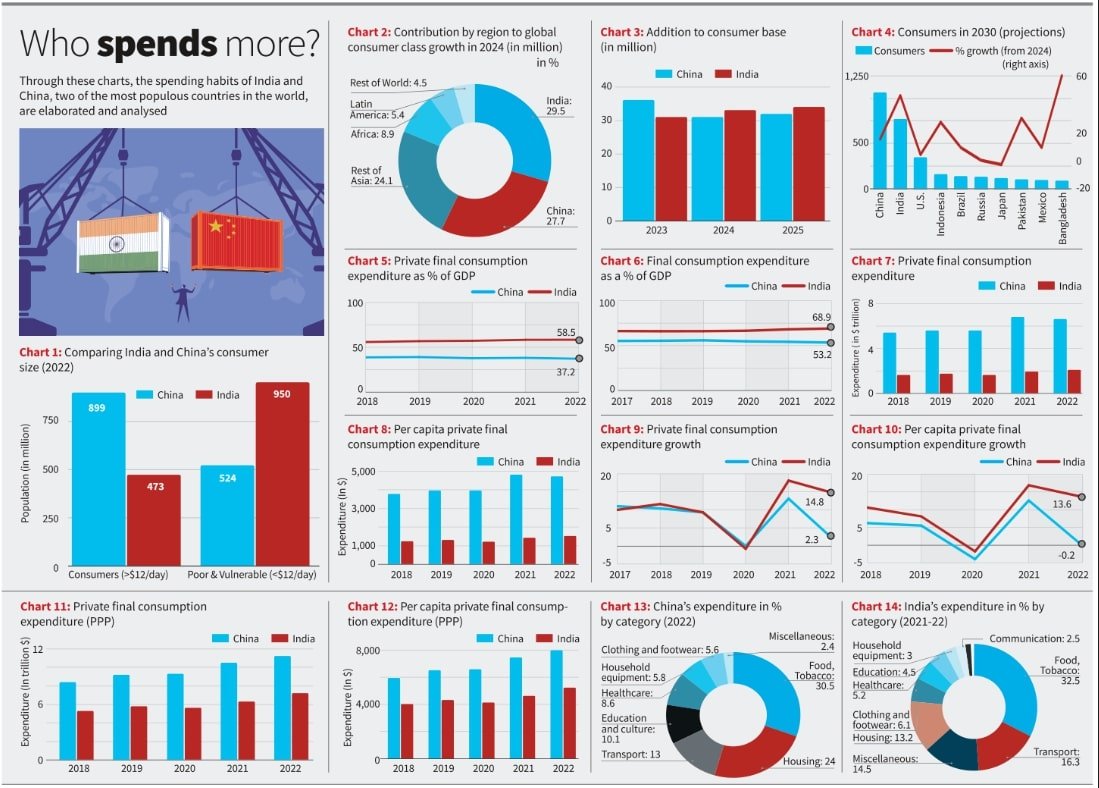

In recent years, the economic dynamics between India and China have drawn considerable attention, particularly in terms of consumption patterns. Both countries, being the most populous in the world, have significant impacts on global markets. This article delves into the comparison of consumption trends in India and China, highlighting key areas such as consumer goods, energy, and the digital economy.

Key Factors

- China is experiencing a decline in its birth rate, currently at 6.4 births per 1,000 people, with a total fertility rate around 1%. This has led to negative population growth for the first time in sixty years, highlighting an increasing dependency ratio.

- India has achieved replacement-level fertility with a total fertility rate of 2.1 and its population is projected to peak by around 2060.

- These demographic shifts are poised to have significant impacts on domestic consumption trends in both nations.

Private Final Consumption Expenditure (PFCE)

Private Final Consumption Expenditure (PFCE) is an indicator of the total spending by households and non-profit institutions serving households on goods and services. When comparing this measure between India and China, several key differences emerge:

- Consumption as a Percentage of GDP: India allocates a significantly higher proportion of its GDP to consumption than China, with India at 58% compared to China’s 38%.

- Overall Consumption Contribution: Including government consumption, final consumption constitutes 68% of India’s GDP, while it makes up 53% of China’s GDP.

- Economic Scale: Despite China’s economy being approximately five times larger than India’s, its PFCE is only about 3.5 times that of India’s.

- Growth Trends: China’s PFCE has shown a substantial increase over the past four years. Conversely, India’s PFCE has steadily grown from $1.64 trillion in 2018 to $2.10 trillion in 2022.

- Recent Changes: In 2022, China experienced a decline in both aggregate and per-capita PFCE, whereas India saw marginal growth in these areas. Consequently, the gap between India’s and China’s PFCE ratios has narrowed from approximately 3.3 to 3.1.

- Per Capita PFCE: The gap in per capita PFCE between China and India slightly widened from around 3.0 times in 2018 to about 3.1 times in 2022.

Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) figures are used to adjust for cost of living differences between countries. In PPP terms:

- Relative PFCE: China’s PFCE is about 1.5 times that of India’s when adjusted for PPP.

- Gap Changes: The relative gap between China and India widened from roughly 1.58 in 2018 to around 1.66 in 2020 and 2021. However, in 2022, India managed to reduce this gap to approximately 1.55.

- Consumption Growth: Despite a worsening exchange rate, India added a trillion dollars to its consumption expenditure (PPP) in 2022.

Expenditure by Categories

The spending patterns in various categories further highlight the differences between the two countries:

- India’s Spending Habits: India spends a larger portion of its consumption on food, clothing, footwear, and transport. This is characteristic of a developing market.

- China’s Spending Habits: In contrast, China, reflecting a more developed market, allocates less to food and beverages. It spends more on housing, white goods, recreation, education, and healthcare.

- Aggregate Spending: In aggregate terms, India spends about half of what China spends on food, transport, communication, and clothing.

- Growth Rates: India’s real growth rate in these categories often outpaces China’s nominal growth rates, indicating a rapid catch-up process in consumer spending.

Consumer Goods

China has historically led in consumer goods consumption due to its earlier economic boom and larger middle class. As of recent years, China’s consumer market is characterized by high consumption of luxury goods, electronics, and automobiles. This is driven by urbanization and increased disposable incomes. India, on the other hand, is experiencing rapid growth in consumer goods consumption. The Indian market shows strong demand in sectors like mobile phones, clothing, and personal care products. The growth in e-commerce has also significantly boosted the availability and consumption of these goods across urban and rural areas.

Energy Consumption

Energy consumption is another critical area of comparison. China remains the world’s largest energy consumer, driven by its massive industrial base and urban population. It has a high demand for coal, oil, and increasingly, renewable energy sources as it aims to reduce pollution and carbon emissions. India’s energy consumption is also growing rapidly but is still behind China. India is focusing on expanding its renewable energy capacity, with ambitious targets for solar and wind energy to meet its growing electricity needs and to reduce dependency on coal.

Digital Economy

The digital economy is a burgeoning sector in both countries, though at different scales. China has a highly developed digital ecosystem, with giants like Alibaba, Tencent, and Baidu leading in e-commerce, social media, and digital payments. China’s internet penetration is high, and innovations like mobile payments and digital financial services are widespread. India, while trailing in some aspects, is catching up fast. The rise of companies like Flipkart, Reliance Jio, and Paytm reflects the growing influence of the digital economy. The government’s push for digital inclusion through initiatives like Digital India has significantly increased internet penetration and digital transactions.

Key Drivers and Challenges

Several factors drive these consumption patterns. In China, robust manufacturing, urbanization, and a large middle class are the primary drivers. For India, a young population, increasing income levels, and digital inclusion initiatives are key factors. However, both countries face challenges. China grapples with slowing economic growth and an aging population, while India faces issues related to income inequality and infrastructural constraints.

Future Outlook

Looking ahead, India is poised to witness substantial growth in consumption due to its demographic dividend and economic reforms. China’s focus might shift towards sustainable consumption and technological innovation as it tackles environmental and economic challenges. Both countries’ consumption patterns will continue to shape global markets, with significant implications for international trade, energy markets, and technological advancements.

These comparisons provide insights into the distinct economic landscapes and consumer behaviors in India and China. While China’s consumption patterns reflect its status as a more mature economy, India’s rapid growth in various consumption categories underscores its dynamic and emerging market characteristics.