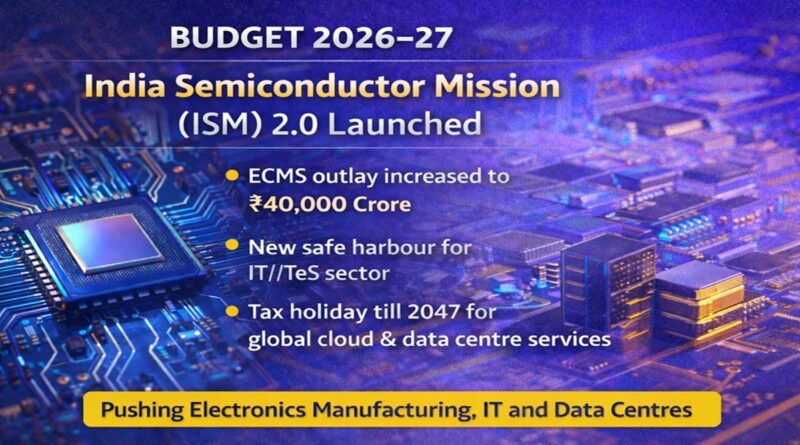

Budget 2026–27 Announces India Semiconductor Mission (ISM) 2.0; Big Push for Electronics, IT and Data Centres

The Union Budget for FY 2026–27, presented today by Union Finance Minister Nirmala Sitharaman, has unveiled a series of major policy measures aimed at accelerating the growth of India’s Electronics, Semiconductor, Information Technology and Digital Infrastructure sectors. The announcements underscore the government’s intent to position India as a global hub for semiconductors, electronics manufacturing, IT services, and data centres.

India Semiconductor Mission (ISM) 2.0 Launched

A key highlight of Budget 2026–27 is the announcement of India Semiconductor Mission (ISM) 2.0, building upon the foundation laid by ISM 1.0.

The new phase of the mission will focus on:

- Producing semiconductor equipment and materials in India

- Designing full-stack Indian semiconductor IP

- Strengthening domestic and global supply chains

- Promoting industry-led research and training centres to develop cutting-edge technology and a skilled workforce

For FY 2026–27, the government has made a budgetary provision of ₹1,000 crore for ISM 2.0. While ISM 1.0 expanded India’s semiconductor ecosystem and manufacturing capabilities, ISM 2.0 is expected to deepen technological self-reliance and move India higher up the semiconductor value chain.

Electronics Components Manufacturing Scheme (ECMS) Gets Major Boost

The Electronics Components Manufacturing Scheme (ECMS), launched in April 2025, has already witnessed strong industry response. According to the Budget statement:

- ECMS has attracted investment commitments at nearly double the original target

- To capitalize on this momentum, the government has proposed to increase the total outlay to ₹40,000 crore

This enhanced allocation is expected to strengthen India’s electronics supply ecosystem, reduce import dependence, and support domestic manufacturing of critical electronic components.

New Safe Harbour Provisions for IT and ITeS Sector

Recognising the IT sector as a core engine of India’s economic growth, Budget 2026–27 proposes significant reforms to provide tax certainty and ease of compliance for IT and IT-enabled services (ITeS).

Single Category for IT Services

India is a global leader in:

- Software development services

- IT-enabled services (ITeS)

- Knowledge Process Outsourcing (KPO)

- Contract R&D services related to software

Acknowledging the interconnected nature of these segments, the Budget proposes to club all such services under a single category: “Information Technology Services”, with:

- A common safe harbour margin of 15.5% applicable across the sector

Higher Threshold for Safe Harbour

- The threshold for availing safe harbour benefits for IT services is proposed to be increased from ₹300 crore to ₹2,000 crore, providing relief to a much larger set of companies.

Automated Approval and Long-Term Certainty

- Safe harbour approvals will be granted through an automated, rule-driven process, eliminating the need for tax officer examination.

- Once opted, companies can continue the same safe harbour arrangement for five consecutive years, at their discretion.

Faster Advance Pricing Agreement (APA) Process

For IT services companies opting for Advance Pricing Agreements (APA), the Budget proposes:

- Fast-tracking of the Unilateral APA process, with a target to conclude it within two years

- An additional six-month extension available on taxpayer request

- Extension of the modified return facility not only to the entity entering into APA, but also to its associated entities

These measures are expected to significantly reduce transfer pricing disputes and improve investor confidence.

Tax Holiday Till 2047 for Global Cloud and Data Centre Services

To boost investment in data centres and digital infrastructure, Budget 2026–27 proposes a landmark incentive:

- A tax holiday till 2047 for any foreign company providing global cloud services using data centre services located in India

However, such companies must:

- Serve Indian customers through an Indian reseller entity

Additionally:

- A safe harbour margin of 15% on cost has been proposed where data centre services are provided from India by a related entity

This move is expected to position India as a preferred global data centre and cloud services hub.

High-Powered Committee on Education, Employment and Services Sector

The Budget also proposes the formation of a High-Powered ‘Education to Employment and Enterprise’ Standing Committee. The committee will:

- Focus on the Services Sector as a key driver of Viksit Bharat

- Assess the impact of emerging technologies, including Artificial Intelligence (AI), on jobs and skill requirements

- Recommend measures to align education, skilling, and enterprise creation with future workforce needs

Conclusion

The announcements in Union Budget 2026–27 mark a decisive push towards building a technology-driven, self-reliant and globally competitive India. With the launch of ISM 2.0, enhanced support for electronics manufacturing, major tax certainty measures for IT services, and long-term incentives for data centres, the government has laid a strong foundation for India’s next phase of digital and industrial growth.

These measures are expected to attract investment, boost innovation, generate high-quality employment, and reinforce India’s position as a global technology and services powerhouse.

Source: PIB