XIRR vs CAGR: Calculations and Differences

When evaluating investment returns, two common metrics often come into play: CAGR (Compound Annual Growth Rate) and XIRR (Extended Internal Rate of Return). Understanding these concepts and their differences is crucial for making informed investment decisions. This article delves into what XIRR and CAGR are, how they are calculated, and their practical applications, particularly in the context of Systematic Investment Plans (SIPs).

What is XIRR?

XIRR stands for Extended Internal Rate of Return. It is a powerful metric used to calculate the annualized rate of return for a series of cash flows occurring at irregular intervals. XIRR is particularly useful for investments with multiple transactions happening at different times, such as SIPs, where investments are made periodically, and withdrawals or redemptions can happen at different points in time.

What is CAGR?

CAGR, or Compound Annual Growth Rate, measures the mean annual growth rate of an investment over a specified period of time longer than one year. It assumes that the investment grows at a constant rate and is ideal for evaluating the performance of investments that have only one initial investment and one final value over the period considered.

What is the Difference Between XIRR and CAGR?

The primary difference between XIRR and CAGR lies in their application and the nature of the cash flows they handle:

- XIRR: Handles multiple cash flows at irregular intervals.

- CAGR: Handles single initial and final values over a fixed period.

Difference Between their Calculation?

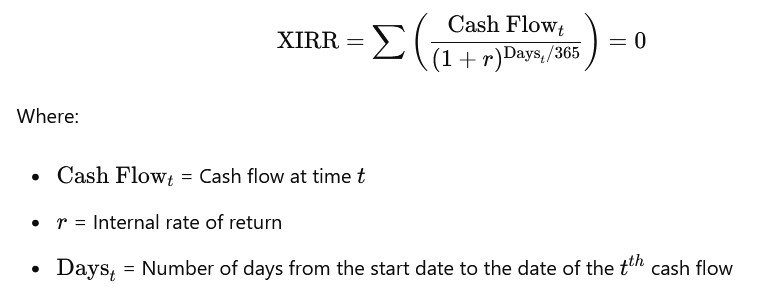

XIRR Calculation:

The XIRR calculation involves finding the rate of return that equalizes the present value of a series of cash flows to zero. The formula used in financial software or spreadsheets (like Excel) is:

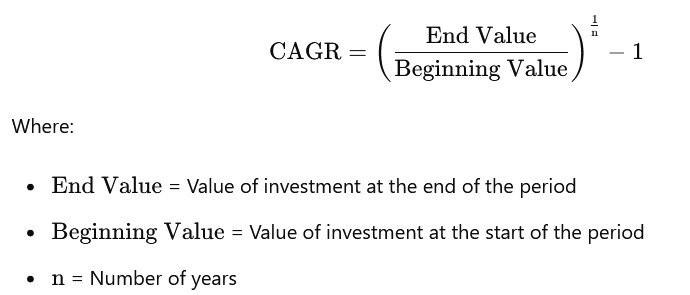

CAGR Calculation:

CAGR is calculated using the formula:

Practical Examples of CAGR and XIRR

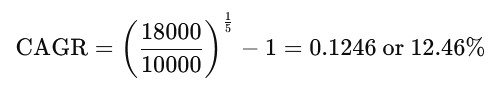

Example of CAGR:

Suppose you invested ₹10,000 in a mutual fund, and its value grew to ₹18,000 over 5 years. The CAGR is calculated as:

Example of XIRR:

Imagine you invested ₹2,000 every six months for three years in a SIP, and the total value at the end of three years is ₹15,000. The cash flows and dates would be entered into an Excel spreadsheet, and the XIRR function would be used to find the annualized return.

Comparing Advantages and Disadvantages

CAGR:

Advantages:

- Simple and easy to understand.

- Useful for single investment over a fixed period.

Disadvantages:

- Assumes constant growth rate, which is unrealistic for many investments.

- Not suitable for investments with multiple cash flows.

XIRR:

Advantages:

- Handles irregular cash flows.

- Provides a more accurate annualized return for complex investment schedules.

Disadvantages:

- More complex to calculate and understand.

- Requires detailed transaction records.

Choosing Between CAGR and XIRR for SIP Investments

For SIP investments, where multiple investments are made at different times, XIRR is the more appropriate metric as it accurately reflects the internal rate of return considering the timing of each cash flow. CAGR, on the other hand, is better suited for lump sum investments where the initial investment grows over a specified period without additional inflows or outflows.

Choosing the Right Metric

The choice between CAGR and XIRR depends on the nature of the investment:

- Use CAGR for straightforward, single-period investments with no additional transactions.

- Use XIRR for complex investments with multiple cash flows occurring at different times, such as SIPs, reinvestments, or withdrawals.

In conclusion, while both CAGR and XIRR are essential tools for assessing investment performance, understanding their differences and applications will enable investors to make more informed decisions and better evaluate the true returns on their investments.

Suggested read: What is Nifty and How It is Calculated?